15 Up-and-Coming Trends About insurance company brooklyn

Not known Details About Renters Insurance - Country Financial

insurance companies new york city

insurance companies new york city

Acquire excessive coverage and also you're shedding hard-earned cash. Buy as well little and also you leave yourself open up to challenge and also considerable monetary loss. For occupants insurance, discovering the appropriate balance means selecting accurate, suitable restrictions for your personal building and responsibility coverage. For the best outcomes, this process may need a little effort.

insurance companies new york city

insurance companies new york city

Personal home coverage is most likely the main reason you buy a renters policy. The protection will reimburse you for protected damages, loss, or burglary of your personal possessions approximately a certain buck quantity, so you'll intend to make certain you obtain that amount right. Doing a residence supply is an excellent way to establish just how much building insurance coverage you need: Follow this step-by-step list to supply your individual home: List each thing, when you got it and the purchase cost or current worth.

When this is done, place your supply in a safe location away from residence - for instance, in a bank safe deposit box. Consider including photos to your supply - they can help if you have a claim. You can likewise utilize our contents calculator to aid you figure out the amount of personal effects protection you desire.

Renters' Insurance - Wikipedia - Questions

You may be eligible for a discount rate when you incorporate the purchase of your State Ranch automobile and also tenants insurance plans. Figure out if you're eligible for costs discount rates on both policies by speaking to a State Farm agent.

Renters insurance provides monetary repayment to cover Click here to find out more an occupant's lost or harmed belongings as a result of fire, burglary or criminal damage. It additionally covers an occupant's responsibility on the occasion that a visitor is injured on the premises. Whether the renters insurance or the proprietor insurance pays for the expenses connected with the injury will rely on the conditions of the occurrence, the area on the premises where the injury takes place, as well as who is at mistake.

Tenants insurance will certainly aid to pay your costs if you suffer a loss, such as a burglary. The amount of payment you will certainly receive depends on the sort of loss and the quantity of protection you have in place. For instance, you can get "actual money value" (diminished) coverage for your personal effects, or you can buy substitute price protection for your personal properties.

Get This Report about What Does Renters Insurance Cover? - The Simple Dollar

You will also be responsible for an insurance deductible, which is an out-of-pocket expenditure. In case a visitor to your house, condominium or home is seriously harmed, that individual can sue with your insurance firm, and your insurance provider will attend to the case. Tenants insurance is essential if you are renting out a home or house and intend to make certain your useful properties are safeguarded from loss, burglary or damage, as well as shields you in case of obligation insurance claims too.

Bring renters insurance safeguards you and the property manager by guaranteeing that whatever takes place on the properties, either your tenants insurance or the landlord's insurance will provide payment. As an instance, what happens if a neighboring occupant leaves cooking unattended and begins an apartment fire that harms your unit and valuables? It's possible that some combination of the next-door neighbor occupant's occupants insurance, the property manager's residential property insurance, as well as the individual residential property insurance in your tenants plan will enter into play to cover the price of repairs.

Landlord insurance covers damage to the building yet does not safeguard your belongings. Another good reason to have occupants insurance is for security against responsibility cases. The obligation section of your renters insurance will give compensation if a site visitor to your leased house is hurt. If that person submits a claim versus you, your occupants responsibility insurance will certainly additionally help to cover the expenses of your lawful protection.

Renters Insurance From First Tech Insurance Services Fundamentals Explained

brooklyn homeowners insurance

brooklyn homeowners insurance

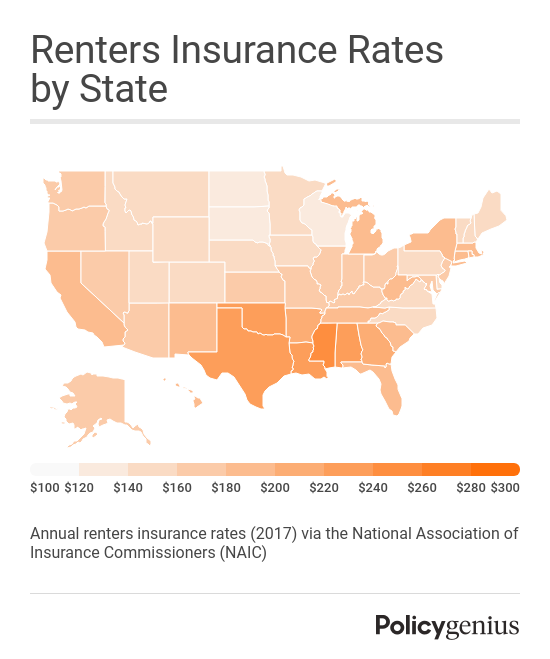

The price of renters insurance is typically quite affordable. You can normally anticipate to pay between $100 as well as $250 per year on standard, depending upon where you live and also the coverage amount you continue the insurance plan. The national standard for occupants insurance is $15 to $30 each month.

https://www.youtube.com/embed/oUzWwoqx2SY

Tenants insurance is not tax obligation insurance deductible other than in the following circumstances: You after that may deduct a part or your occupants insurance, based on the measurements of the room where you run your company family member to the total size of the properties. In this case you can subtract a section of your renters insurance in the same way as a home workplace.